The past four years of Susilo Bambang Yudhuyono’s presidency have shifted the general consensus a shade towards the optimistic, even as opportunities for backsliding on transparency and anti-corruption legislation abound.

INDONESIA : Demographic Dividend or Delusion?

Category: General Info

The past four years of Susilo Bambang Yudhuyono’s presidency have shifted the general consensus a shade towards the optimistic, even as opportunities for backsliding on transparency and anti-corruption legislation abound.

Minister of Health, HE Siti Fadilah Supari, has indicated that the gov- ernment is supporting the state owned firms: “Since the start of the economic crisis in 2008, the government has committed to subsidize the cost of generic drugs to prevent price escalation in 2009.” The four state-owned firms, Kimia Farma, Indofarma, Biofarma, and Phapros, are run as profit-seeking enterprises that can be deployed as instruments of government policy when necessary. The government also runs a medical insurance program for the poor, re- structured in 2008 under the name Jamkes- mas. Dr. Willem Biantoro Wanandi, founder of Anugerah Corporation, analyzes Indonesian

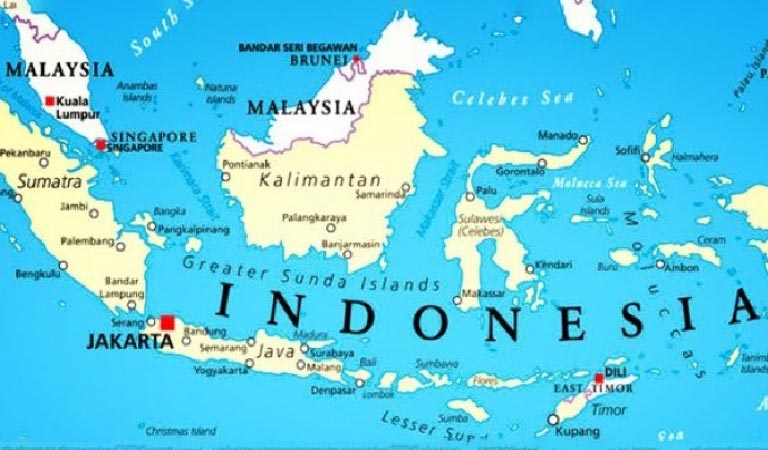

Navigating the Archipelago

Indonesia is one of the most complicated dis- tribution markets in the world. The difficul- ties begin with the country’s geography itself comprising more than 17,000 islands. The country’s poor infrastructure further compli- cates this difficult task. Furthermore, the strategic landscape is complicated by the fact that the top five manufacturers, all local companies, also own distribution businesses. Thus those companies are off limits for independent distributors and the guaranteed business of the parent company subsidizes these distribution businesses allowing them to bring on external cli- ents on the cheap. However, changes are on the horizon. A handful of independent distributors are making headway in a sector crowded with hundreds of competitors. The BPOM’s Slamet has stated that the agency is looking to create incen- tives to increase consolidation in the distribution sector, which is a very encouraging sign for these distributors.

APL is the largest independent distributor and was founded as part of Dr. Wanandi’s Anugerah Corporation. The company is now majority owned by Zuellig Pharma, the largest pharmaceu- tical distributor in Asia. President Director Santiago Garcia was brought into APL to help overcome some of Indonesia’s unique challenges. Previously, the firm was primarily focused on servic- ing its principals. Yet Mr. Garcia says, “Now managers are far more focused on working with customers and visiting branches.

Download PDF Below For More Details